by Mark Moller | Apr 13, 2024 | Tax

Estate planning is an essential yet often overlooked aspect of financial planning. For many Australians, it is seen as something to be dealt with later in life, if at all.

by Mark Moller | Dec 20, 2022 | Financial Tips

Employers love to reward their hard working employees and valuable clients in various ways. However, there are important issues to consider when providing ‘Entertainment’ (including Christmas Parties and Gift Cards) to staff and clients. We know this can be confusing,...

by Mark Moller | May 24, 2022 | News

As 30th June fast approaches, the focus usually shifts towards ensuring strategies relating to managing taxation outcomes and Superannuation are implemented before the end of financial year arrives. However, it is also important to look ahead, with some Superannuation...

by Mark Moller | Feb 7, 2020 | News

If you applied for a home loan in the current financial environment , your lender would probably assess your application in the context of both your credit score and your credit history – on top of your income, assets, liabilities and living expenses. Your credit...

by Mark Moller | Nov 1, 2019 | Financial Tips

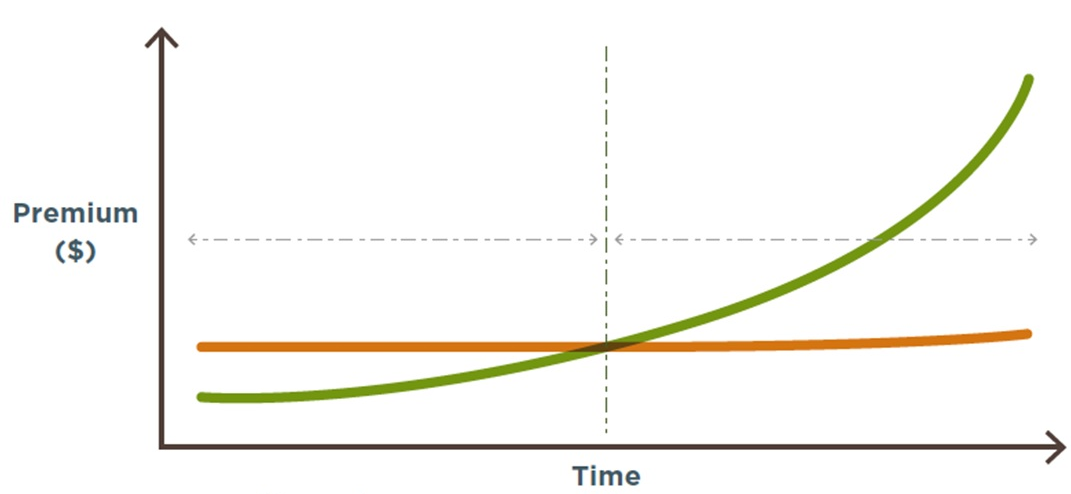

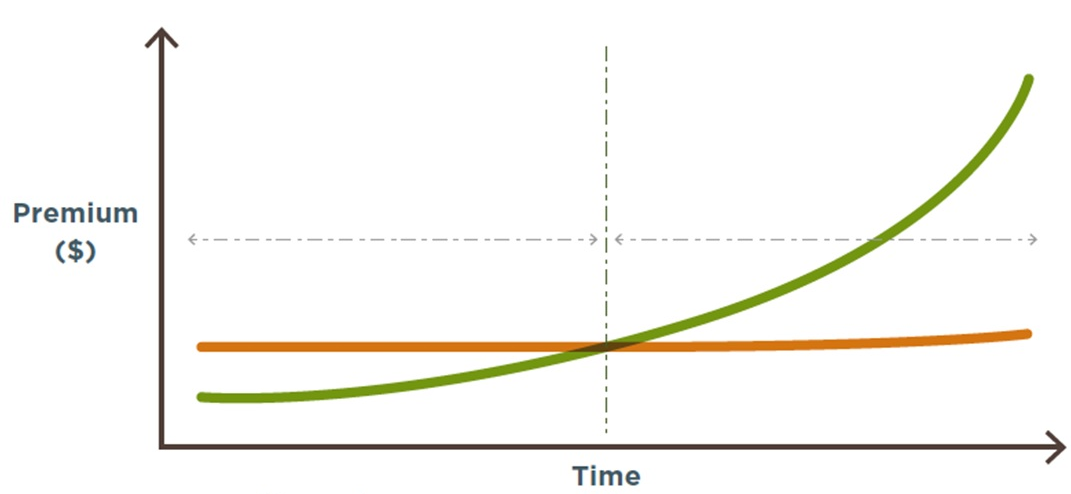

Life insurance premiums are predominantly based on the risk of certain events happening to you. Because health risks increase with age, life insurance premiums will generally increase over time. That’s why most insurers offer two common ways of paying for, and...