by Mark Moller | Dec 20, 2022 | Financial Tips

Employers love to reward their hard working employees and valuable clients in various ways. However, there are important issues to consider when providing ‘Entertainment’ (including Christmas Parties and Gift Cards) to staff and clients. We know this can be confusing,...

by Mark Moller | Nov 1, 2019 | Financial Tips

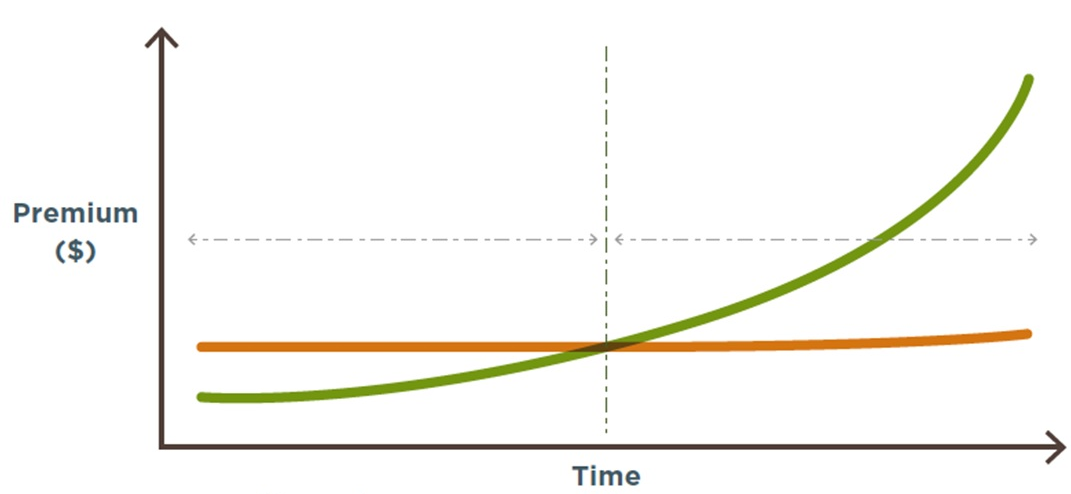

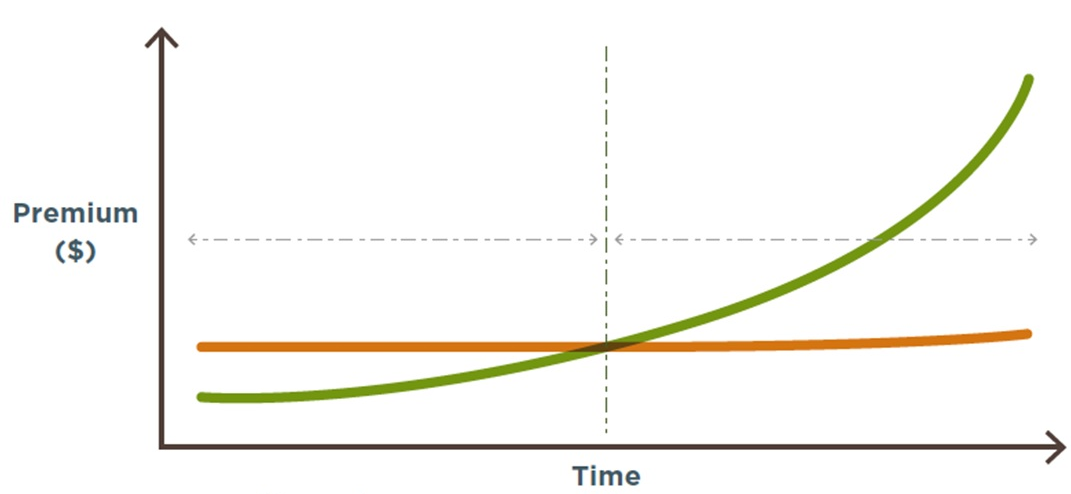

Life insurance premiums are predominantly based on the risk of certain events happening to you. Because health risks increase with age, life insurance premiums will generally increase over time. That’s why most insurers offer two common ways of paying for, and...

by Mark Moller | Oct 12, 2018 | Financial Tips

The real estate market can be tough for young adults, but as a parent you may be able to lend a helping hand. We have explained some options below: 1) Family / Security Guarantee If your child does not have enough security / deposit for a mortgage, you could provide a...

by Mark Moller | Dec 15, 2017 | Financial Tips

There are a range of home loans available in Australia, so it can be hard to understand their features and whether they are right for you. This guide explains all you need to know. Variable Loans Variable loans are loans that are subject to interest rate fluctuations....

by Mark Moller | Jul 28, 2017 | Financial Tips

A home loan is generally a long-term proposition, but in some situations it can make sense to refinance your mortgage. Read this guide to the refinancing process, and speak to your broker, before deciding whether it’s right for you. Refinancing involves taking out a...

by Mark Moller | Jul 14, 2017 | Financial Tips

Savvy borrowers have an endgame in sight before they even apply for a home loan, and with the right mortgage offset account, they could win that game even more quickly. Home buyers usually focus on the here and now, not the distant future. Rather than the size of...